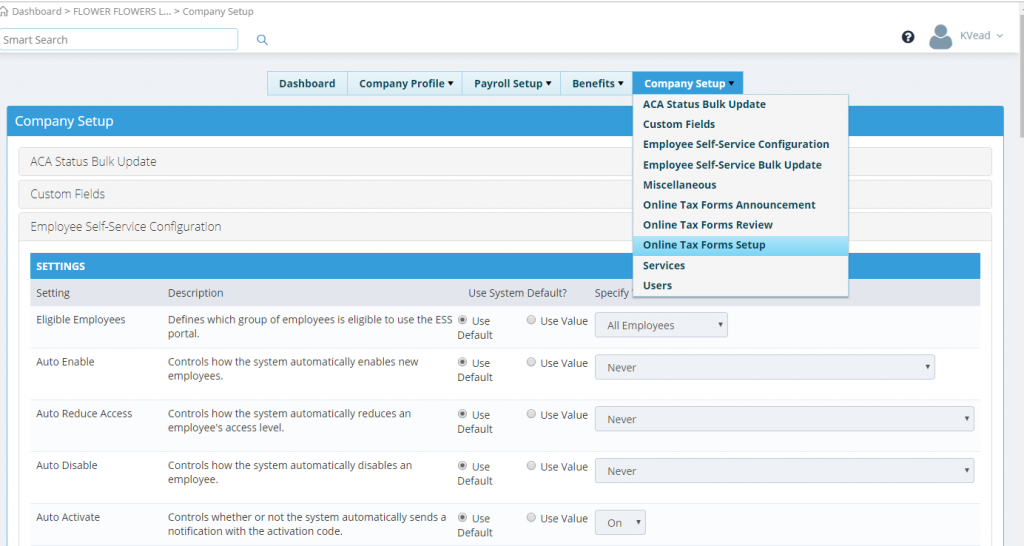

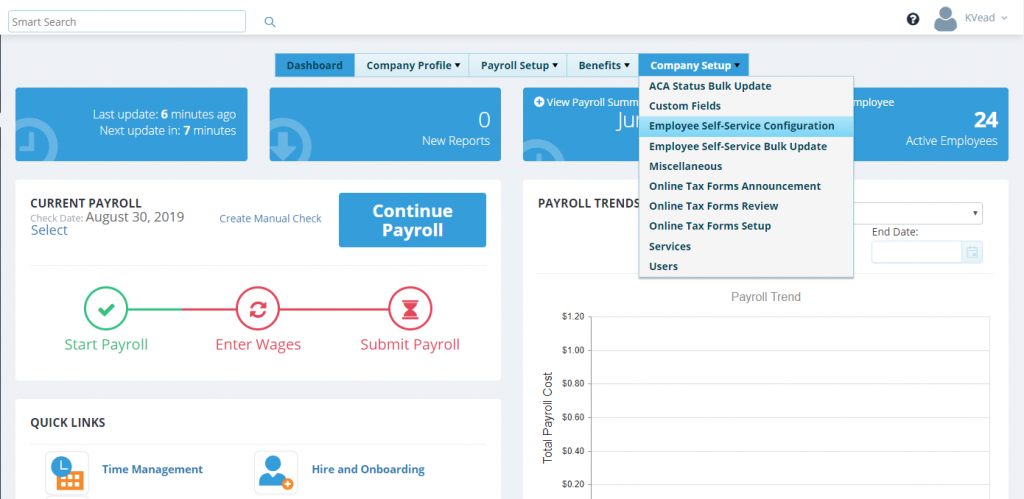

From the main dashboard of Payentry, hover over the Company Setup and select the option for Employee Self Service Configuration.

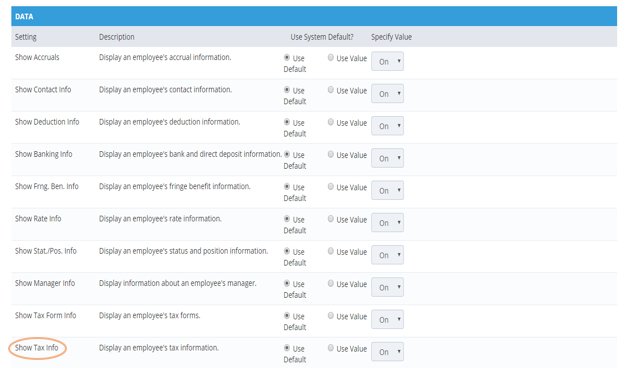

The Data section allows you to determine what employee information displays in My Payentry.

The default section is TRUE for all sections, meaning that unless you choose to turn it all off, all of the information in this section is available to be viewed in My Payentry.

Show Tax Form Info: Specifies whether employee tax form information displays in My Payentry. Once forms have been released, they will display in the My Documents section of My Payentry.

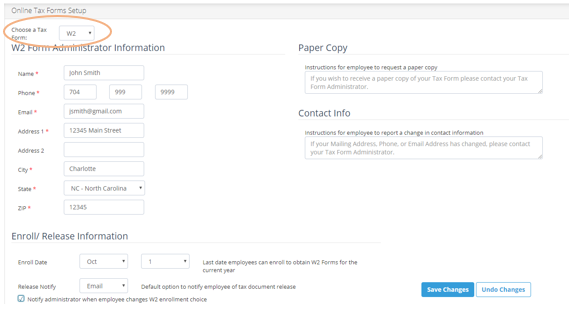

After review of the Employee Self Service Configuration, add your company’s Year End Form Administrator Information by hovering over Company Setup and selecting Online Tax Form Setup.

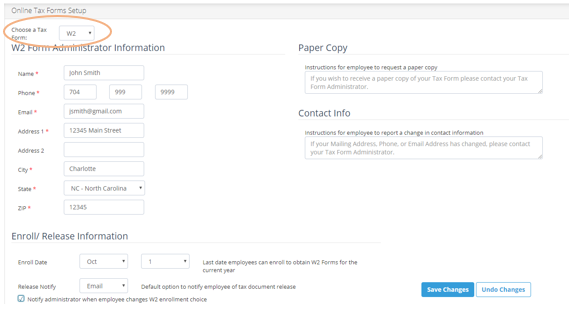

Choose the W-2 Dropdown.

Fill in the appropriate contact information for Name, Phone, and so on.

Enter the instructions that describe how an employee can receive a paper copy in the Paper Copy text area, if desired.

Enter the instructions for how an employee can contact the tax form administrator in the Contact Info text area, if desired.

Determine the cut-off date – the last date on which an employee can enroll for this online tax form service – in the Enroll Date drop down lists.

Use the Release Notify drop down list to select the default method of notifying the employee that their tax form has been released.

These notifications are automatically generated whenever a release if performed for either all employees or an individual.

Valid entries include:

- Email – sends an email to each employee

- Mail – creates a generated letter in PDF format that you can print and send via the postal service

- None – does nothing, employees are not automatically notified.

** You are required by law to notify employees that their forms are available. If you choose the None method, you can notify each employee individually using the Notify Employee field.

Put a check in the Enroll Notify check box if you, the tax form administrator, want to be notified via email that an employee has changed their enrollment status for this service.

When you are done, click Save Changes.

Next, change the Choose a Tax Form dropdown to 1099 and fill out the same information for the 1099 Form Administrator Information*. Save Changes.

*Please note that even if you do not currently have any employees who receive 1099 forms at the end of the year, the 1099 Form Administrator information must be completed in order to release tax forms to your employees*