Legal & Voluntary Benefits for Businesses

As employers shift to meet employee demands for supplementary benefits options, Payentry has expanded its suite of services to include voluntary benefit programs for businesses.

Huntersville, NC, September 7, 2021 – Payentry Financial Services, a leader in employee benefits consulting for insurance and financial services, announced that the company will now offer voluntary benefits as the newest addition to Payentry’s suite of services. Two key benefits are: Legal and ID Theft protection plans made available through LegalShield, and a voluntary benefits membership program in partnership with the Association for Entrepreneurship USA (AFEUSA).

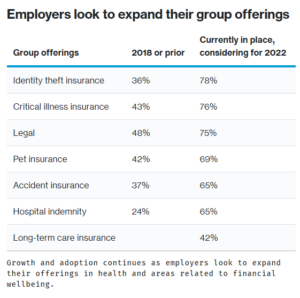

Adoption of voluntary benefit programs has increased drastically over the past several years. According to a recent survey conducted by Wills Towers Watson, employers are investing more in areas related to the health and wellbeing of employees. Traditionally, small businesses may not be able to afford to offer voluntary insurance or meet the minimum participation requirements. However, the Payentry programs are designed for any size business with no minimum requirements. Employees can even enroll in these programs without an employer sponsor.

With a network of provider law firms across the US and Canada, LegalShield’s lawyers have an average of 22 years of experience, proficient in all fields of law. Signing up for a legal service plan can save individuals and businesses thousands of dollars over hiring an attorney directly. Providing these services for over 48 years has set LegalShield apart from the competition. Their IDShield service excels at not just monitoring, but offers complete restoration by licensed, private investigators who go to work on the persons behalf to restore them back to pre-theft status. With several different subscription options, choosing LegalShield through Payentry opens up discount opportunities for employers and provides membership benefits for employees.

- Business Legal Plans help employers navigate complex situations like contract review, HR matters, tax questions or audits, internet security breaches, contractor disputes and more.

- LegalShield includes will preparation, unlimited consultation on personal matters, family law assistance, court representation, contract review and 24/7 emergency access for members.

- IDShield provides individuals with comprehensive identity protection that includes monitoring, alerts and full restoration provided by licensed, private investigators.

Payentry Financial Services CEO, Geoffrey Duke, shared, “We are pleased to be able to offer legal and identity protection services through an industry leader in LegalShield. As we expand our insurance programs across the US, improving individuals’ access to beneficial programs to reduce their risk is a top priority for us.”

In response to the increased need for voluntary benefits programs among our clients, Payentry Financial Services is partnering with the Association for Entrepreneurship USA, to offer a voluntary benefits membership program with tele-health, prescription and vision included. Unlike anything else available in the insurance market, this program allows employees to enroll in a membership with AFEUSA which provides access to additional voluntary benefits without health underwriting or minimum participation requirements. Employers can choose to contribute to the monthly plans or not – giving them complete flexibility. Enrollment in the AFEUSA membership provides individuals access to the following guaranteed issue Insurance options:

- Accident Medical

- Accident and Sickness Hospital Indemnity

- Critical Illness

- PPO Dental Insurance

- Basic Life $25K benefit

- Term Life $75K benefit

Access to these benefits can be life changing for individuals and small businesses, and cash benefits make unexpected situations less financially burdensome during difficult times. A Businesswire study shows that nearly half of HR professionals (45%) agree that offering voluntary benefits helps attract new talent, and over 70% of employees would like their employers to offer these benefits. “If you are a small business who is fighting for top talent to join or stay on your team, exploring these programs will open up new and meaningful opportunities for your employees to be better prepared for the future,” said Geoffrey Duke.

Details regarding the LegalShield program with Payentry can be found HERE.

CLICK HERE for more information regarding the AFEUSA Membership program.

For more information, please contact:

MPAY, Inc.

Heather Duke, MBA

Chief Marketing Officer

704-727-8223