How to Avoid a Payroll Scam

Just recently, I received an email from one of our employees asking me to help them change their direct deposit account information. I am not the person who handles that type of payroll change, so I told the employee who to contact. Had I known about the latest scam out there, I would have realized that it wasn’t an employee asking me for help. It was an online thief attempting to take an employee’s hard-earned money with a clever scam!

See more details about this type of scheme on this CNBC news article and warning from the IRS.

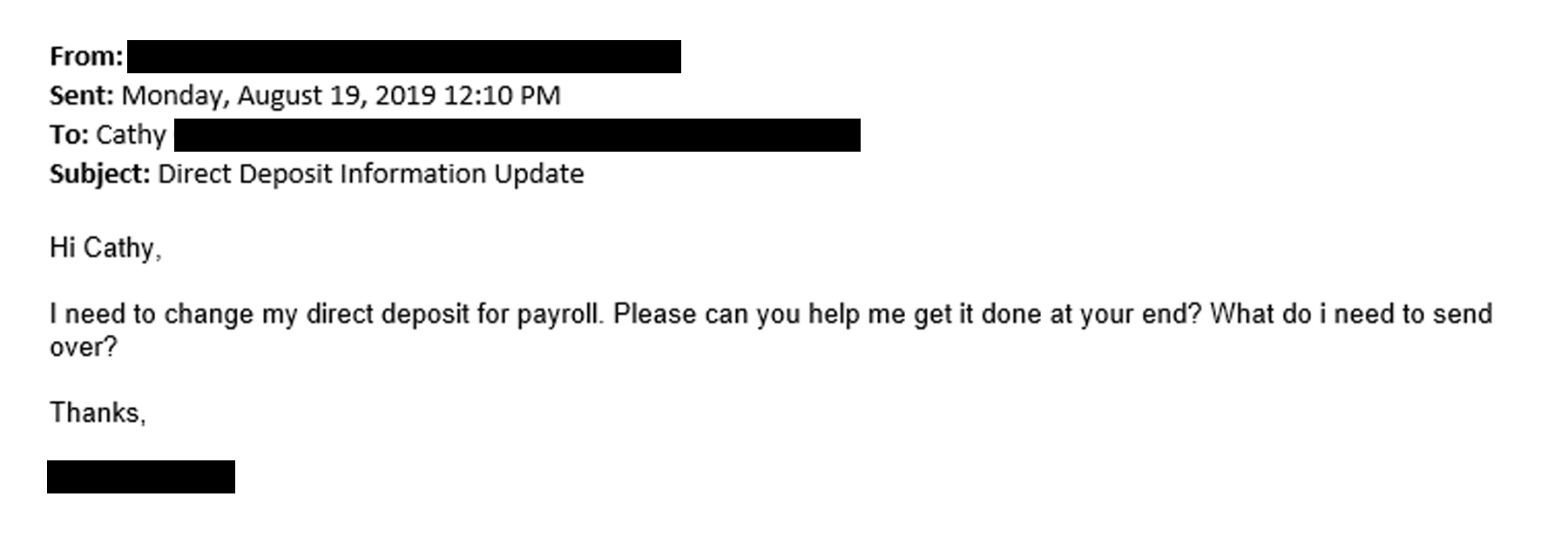

The email looked something like this…

Payroll scams are carried out by cybercriminals who send fake email messages impersonating an executive or employee of the company. With a simple, nicely worded email they deceive HR and Payroll managers into changing an employee’s bank account information to an account controlled by the scammer. On the next payday, the employee is upset when their bank account does not show a payroll deposit. After an investigation, the company realizes what has happened and is faced with a loss they cannot recover.

Payroll scams are carried out by cybercriminals who send fake email messages impersonating an executive or employee of the company. With a simple, nicely worded email they deceive HR and Payroll managers into changing an employee’s bank account information to an account controlled by the scammer. On the next payday, the employee is upset when their bank account does not show a payroll deposit. After an investigation, the company realizes what has happened and is faced with a loss they cannot recover.

Avoiding this type of scam requires educating those who might be targets on the types of phishing scams that they could encounter. Picking up the phone and verifying that the email was actually sent by the employee or requiring them to complete a written form in your office are two ways to ensure that you don’t get taken.

Or, avoid the scams altogether. Take advantage of the benefits of an online employee self-service portal, like My Payentry, which allows employees to make changes to their account through a secure website. This removes the need for HR and payroll involvement in handling important employee updates on behalf of employees and saving employers unnecessary hassle and increased costs related to these scams. Enabling My Payentry is no extra cost for the company, but great added security for you and your employees.

Take precautions today to ensure that your system of validating requests for payroll changes is secure. A few basic rules and a little education for your employees will protect you from losses in the future!