Earned Wage Access 101

by ZayZoon

What is Earned Wage Access (EWA) and how does it help improve employee performance?

It’s no secret: the cost-of-living crisis is impacting employees. 52 percent of employees stress about their finances daily or multiple times a day.

Employees today are struggling to make ends meet and often taking out high-interest loans or getting dinged with everything from bank fees to late fees. It’s taking a toll and impacting their ability to do their best work.

- 63 percent of HR professionals state financial stress negatively impacts work performance.

This is where earned wage access (EWA)comes in. 63 percent of workplaces report a rise in productivity after adopting EWA.

What is EWA?

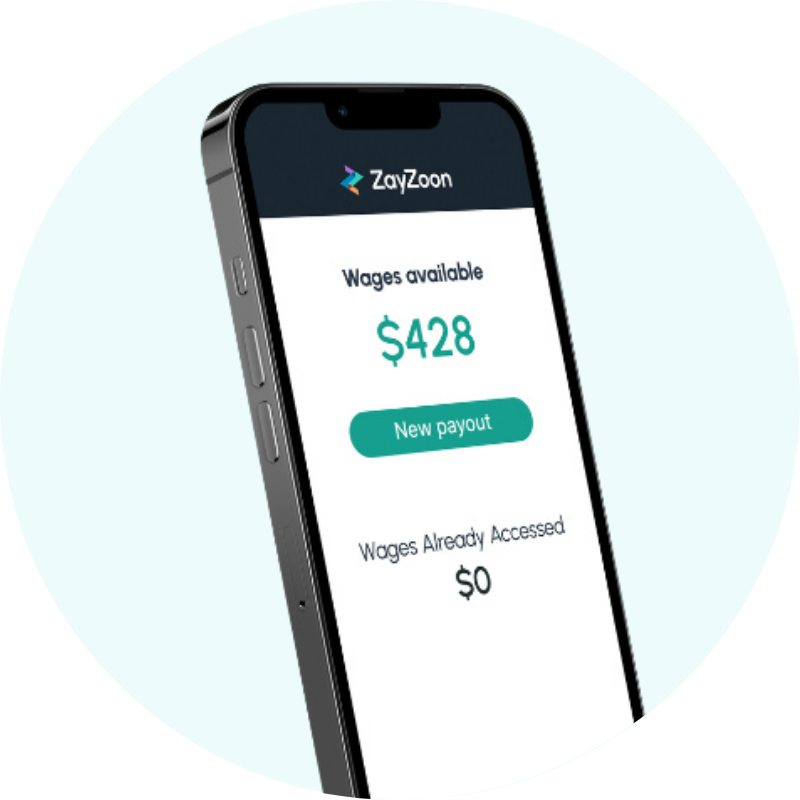

EWA allows employees to access their earned wages ahead of payday. Employees can access a percentage of the wages they’ve already earned whenever they want, interest-free.

EWA is a financial wellness benefit or part of a financial wellness program. A financial wellness program is something offered to employees as a benefit and is an investment in the wellbeing of your employees and organization.

EWA employer benefits

Decrease employee financial stress

EWA gives employees much-needed flexibility. With early access to their earned wages before payday, they can meet unexpected expenses without having to resort to predatory lenders. With EWA, employees have the flexibility to handle unexpected expenses.

- 74 percent of ZayZoon customers cite a significant improvement in financial stress with EWA.

HR pros on the impact of EWA and financial wellness programing

The impacts of earned wage access go beyond employee financial stress. ZayZoon surveyed 500 HR professionals for their state of financial wellness report. They found EWA can drive organizational success in numerous ways, including:

Morale and productivity boosts

- 64 percent of HR leaders who have used EWA say their workplaces experienced increased morale.

- 63 percent of workplaces report a rise in productivity after adopting EWA.

Absenteeism decrease

- 25 percent of employers offering EWA saw decreased absenteeism.

Reduce employee stress

- 46 percent of respondents observed a reduction in employee financial stress when offering EWA.

Ability to attract talent

- 42 percent of employers found that offering EWA helped attract top talent.

- 81 percent of HR leaders believe that offering EWA provides a competitive advantage in attracting skilled employees.

Reduced turnover

- 29 percent of companies using EWA also saw a decrease in turnover.

Reduce hiring costs

ZayZoon businesses offering loan programs to employees have saved up to $8,000/year by providing access to earned wages instead.

Through research conducted by ZayZoon, employers who offer access to earned wages, see a 5 percent reduction in hiring costs, representing savings of about $19,000/year for a business of 200 FTE on average.

No more pay advances

Employees often look to their employer for help when they are struggling with their finances in the form of pay advances. As people operations teams usually have to process pay advances on their own, it can be very time consuming and expensive to do.

Many employees also feel shame and embarrassment when asking for a pay advance as they have to disclose why they need an advance. With EWA, employees can access their wages on-demand without notifying their employer.

Incentivize moving from paper checks

Paper checks Paper checks are going the way of the dinosaur. And, for very good reason: paper checks are ten times more expensive than making payments digitally.

One way savvy business pros are getting their workforce off paper checks is by offering EWA. It incentivizes the transition while giving employees the option to get paid whenever and however, they want.

This is an effective strategy to get the employees who do have a bank account to choose direct deposit to receive their paychecks.

How much does earned wage access cost?

We covered this in the previous section, but just in case the folks in the back missed it: EWA costs employers nothing.

You heard that right. Zilch.

However, there are fees for employees—$5 at most, to be exact, or about what it costs to use an ATM machine.

That said, ZayZoon does provide a couple free options for employees who want to get paid early.

ZayZoon instant gift cards

When employees withdraw some or all their earned wages into our Instant Gift Cards, they get a bonus of up to 25 percent. There are hundreds of brands to choose from, like Walmart, DoorDash and Amazon. Instant Gift Cards are redeemed instantly via email. They are free and they never expire.

ZayZoon Visa® prepaid card

This card has no fees and requires no maintenance. Employees can use it for free, without the $5 payout fee. Plus, no offboarding is required. Employees can use it to get paid long after they leave your business.

ZayZoon gas card

5 percent off whenever you use the card for Gas. For example, if a person wants to take out some of their wages to use on a $50 gas card, they’ll always have a bonus $2.50 added to the card, totaling $52.50 to use on gas for their vehicle.

ZayZoon: A holistic approach to financial wellness

ZayZoon’s earned wage access is one of ZayZoon’s many employee financial empowerment offerings. A holistic approach to financial wellness addresses both short-term employee needs and provides resources for long-term financial growth. That’s why ZayZoon’s offering goes beyond earned wage access to also include financial literacy and wellness services like:

- Financial education services and resources such as an easy-to-use budgeting and home affordability tool and retirement analyzer

- Smart insights based on employee income, spending habits and expenses

- Customized alerts that employees can set to notify them when they’re at risk of incurring minimum balance or overdraft fees

Learn more about ZayZoon’s financial wellness offerings.

Money Mindset Quiz: personalized financial wellness for ZayZoon customers

The journey to financial wellness begins with understanding our personal financial goals and building habits we can stick to. It can be challenging to build a financial roadmap alone.

ZayZoon’s Money Mindsets Quiz helps employees understand their financial habits, gain personalized support and advice.

After completing the 20-question quiz, employees receive their spending personality along with personalized financial education and a ZayZoon financial wellness toolkit with tailored ZayZoon resources and offerings to help them achieve their financial goals.

Employers can use the quiz to identify team spending habits, tailor financial wellness supports for staff, and reduce employee stress.

We collaborated with leading academics in psychology, economics and behavioral finance to ensure the project is grounded in the latest research. Learn more about the creation and research behind the quiz.

Improve employee performance with ZayZoon

Providing employees with earned wage access not only strengthens their financial well-being but also leads to higher productivity, reduced stress, and improved job satisfaction—directly improving team performance.

Curious to learn more about EWA or find out how ZayZoon can help you? Let’s Talk! You can also get started with ZayZoon anytime. Our payroll and HR solutions ensure accuracy, compliance, and efficiency. Contact us today to learn how we can support your business.

Payentry personnel management professionals provide expert support in payroll, workforce management, human resources, benefits administration, and retirement planning services.

For the latest updates, to view our webinars, and listen to our podcasts, visit and follow us on LinkedIn, Facebook, X, Instagram, YouTube and Spotify.

Learn more about how we can help you achieve your goals, address challenges, and resolve issues with speed and precision by conveniently scheduling an appointment with our team. And to speak directly with an experienced payroll professional, please contact us at 888.632.2940 or simply Click Here and Let’s Talk.

* MPAY LLC dba Payentry (Company), is not a law firm. This article is intended for informational purposes only and should not be relied upon in reaching a conclusion in a particular area of law. Applicability of the legal principles discussed may differ substantially in individual situations. Receipt of this or any other Company materials does not create an attorney-client relationship. The Company is not responsible for any inadvertent errors that may occur in the publishing process.