These quick, insightful reads get to the point.

Whether it’s industry insights, expert tips, company culture highlights or just a little inspiration to brighten your workday, our approach keeps things fresh, relevant and easy to enjoy.

For many employees approaching retirement age, or already there, navigating Medicare can be one of the most confusing

Payroll has traditionally been seen as a back-office function that is essential and operational. However, in today’s data-driven business landscape...

As your business grows, so do your payroll needs. What started as a simple payroll process may no longer be enough to keep up with the complexity...

As the workplace continues to evolve, one thing remains constant: company culture matters. In fact, it’s more important than ever.

Properly classifying workers is one of the most important and riskiest aspects of operating a business. Employee versus independent contractor.

Trust is the foundation of a strong workplace culture. Employers invest heavily in HR and HCM initiatives designed to engage employees,

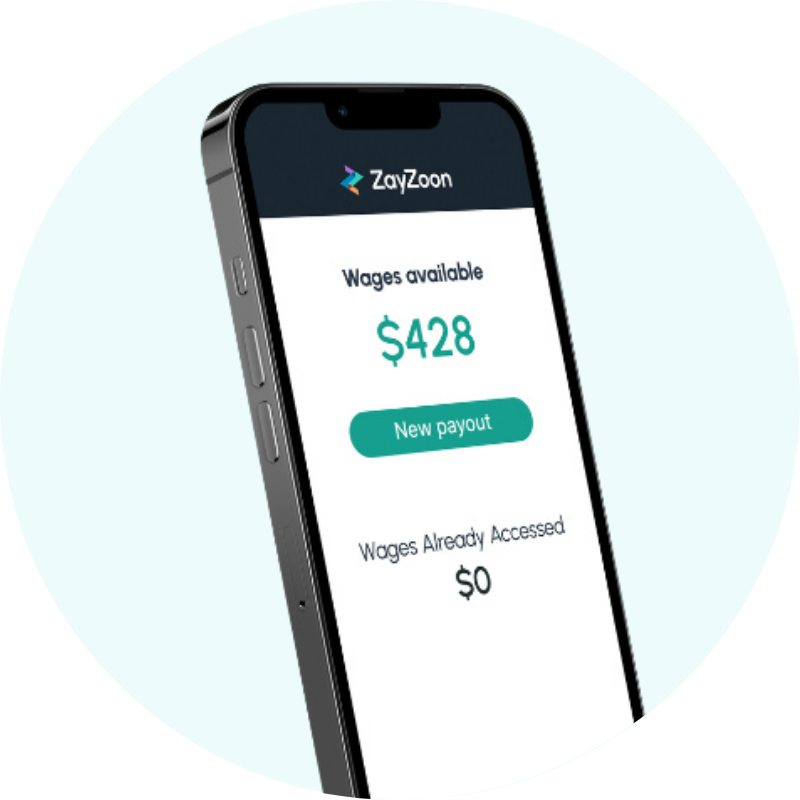

What is Earned Wage Access (EWA) and how does it help improve employee performance?

As we reach the halfway mark of the year, it’s the perfect time for HR professionals and business owners to hit pause, reflect...

As summer approaches and employees begin planning their vacations, organizations often face challenges in managing Paid Time Off (PTO)...

The middle of the year is the perfect time for organizations of all sizes to conduct a payroll review. A mid-year payroll check ensures...